Basel Iii Pillars

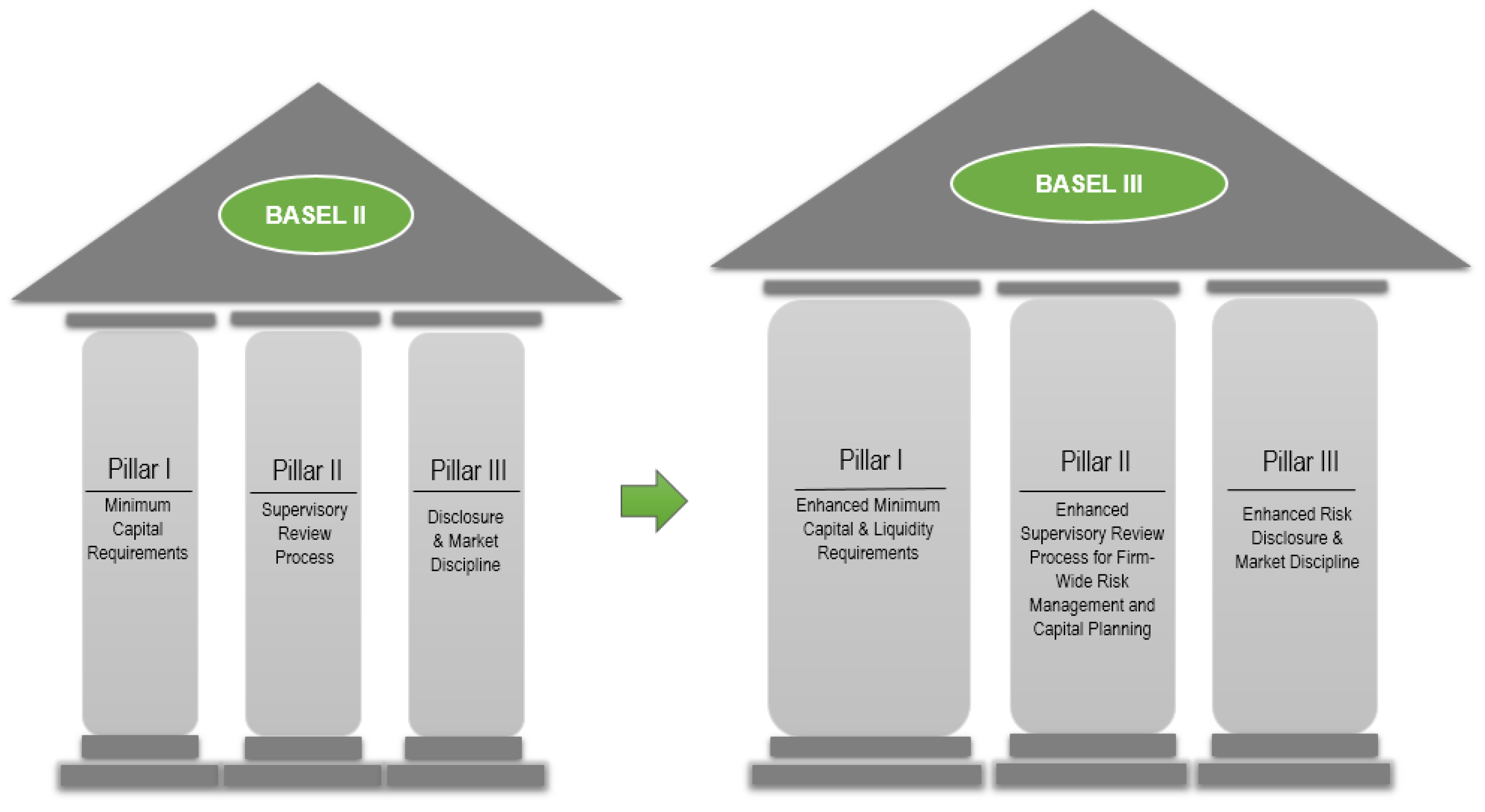

Pillar 1 capital adequacy requirements pillar 2 supervisory review. Pillar 2 enhanced supervisory review process for firm wide risk management and capital planning.

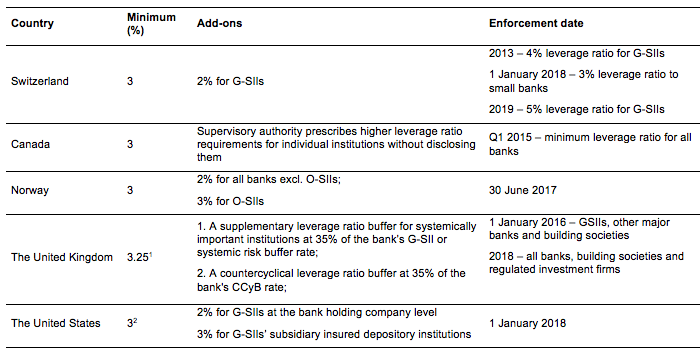

The Leverage Ratio As A Macroprudential Policy Instrument Vox

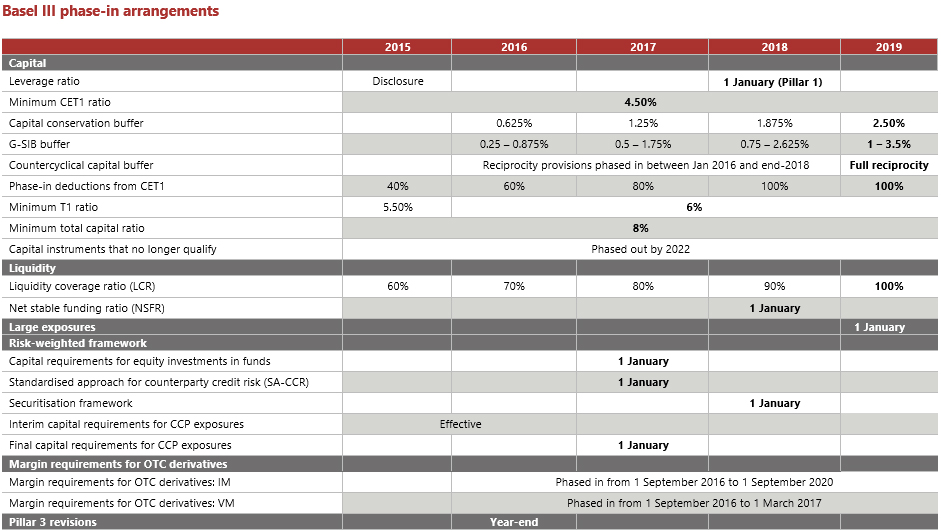

Basel iii is part of the continuous effort to enhance the banking regulatory framework.

Basel iii pillars. Basel iii is an extension of the existing basel ii framework and introduces new capital and liquidity standards to strengthen the regulation supervision and risk management of the whole of the banking and finance sector. Basel iii includes three complementary pillars. Pillar 3 enhanced risk disclosure and market discipline.

This third installment of the basel accords see basel i basel ii was developed in response to the deficiencies in financial regulation revealed by the financial crisis of 200708. The basel iii accord is a set of financial reforms that was developed by the basel committee on banking supervision bcbs with the aim of strengthening regulation supervision and risk management systemic risk systemic risk can be defined as the risk associated with the collapse or failure of a company industry financial institution or an entire economy. These 3 pillars are minimum capital requirement supervisory.

Basel iii is a global regulatory capital and liquidity framework established by the basel committee on banking supervision basel committee. Implementation of the basel accords. This standard represents the second phase of the committees review of the pillar 3 disclosure framework and builds on the revisions to the pillar 3 disclosure published by the committee in january 2015.

Basel iii or the third basel accord or basel standards is a global voluntary regulatory framework on bank capital adequacy stress testing and market liquidity risk. The basel iii guidelines are based upon 3 very important aspects which are called 3 pillars of the basel ii. The most recent information from the basel committee on banking supervision bcbs can be found on the website for the bank for international settlements.

Gk general studies optional notes for upsc ias banking civil services. It builds on the basel i and basel ii documents and seeks to improve the banking sectors ability to deal with financial stress improve risk management and strengthen the banks transparency. Basel committee on banking supervision reforms basel iii strengthens microprudential regulation and supervision and adds a macroprudential overlay that includes capital buffers.

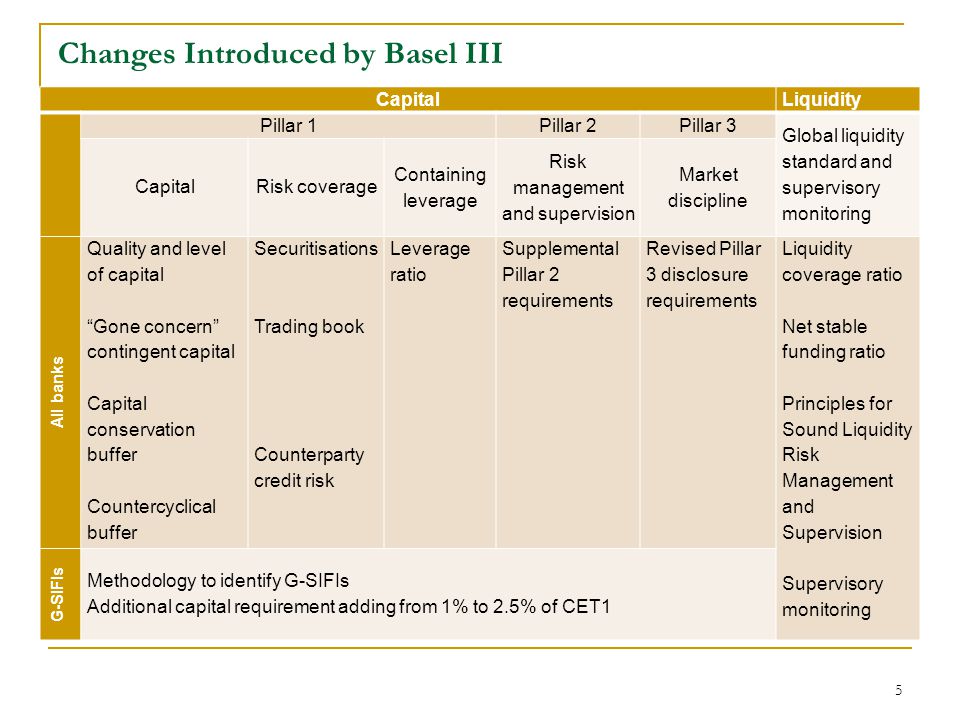

Capital liquidity pillar 1 capital containing leverage risk coverage risk management and supervision market discipline global liquidity standard and supervisory monitoring. Pillars of basel iii accord pillar 1 enhanced minimum capital liquidity requirements. The basel committee on banking supervision has issued the pillar 3 disclosure requirements consolidated and enhanced framework.

The aggregate global indicator amounts for each systemic indicator gsib denominators for use in the boards gsib risk based capital surcharge can be found here.

Basel Accords Yesterday Today And Tomorrow Deutsche Bank

Basel Accords Daren Warner Chief Financial Officer Ppt Download

Ibm Knowledge Center

From Basel I To Basel Iii Overview Of The Journey Basel 1 2

Jrfm Free Full Text The Good And Bad News About The New

Basel Capital Accord Wikibanks

Overview Of Basel Iii And Related Post Crisis Reforms Executive

Basel Iii And The Control Of Financial Fragility Ppt Video

Ppt Moody S Analytics The Institute Of Banking Symposium Risk